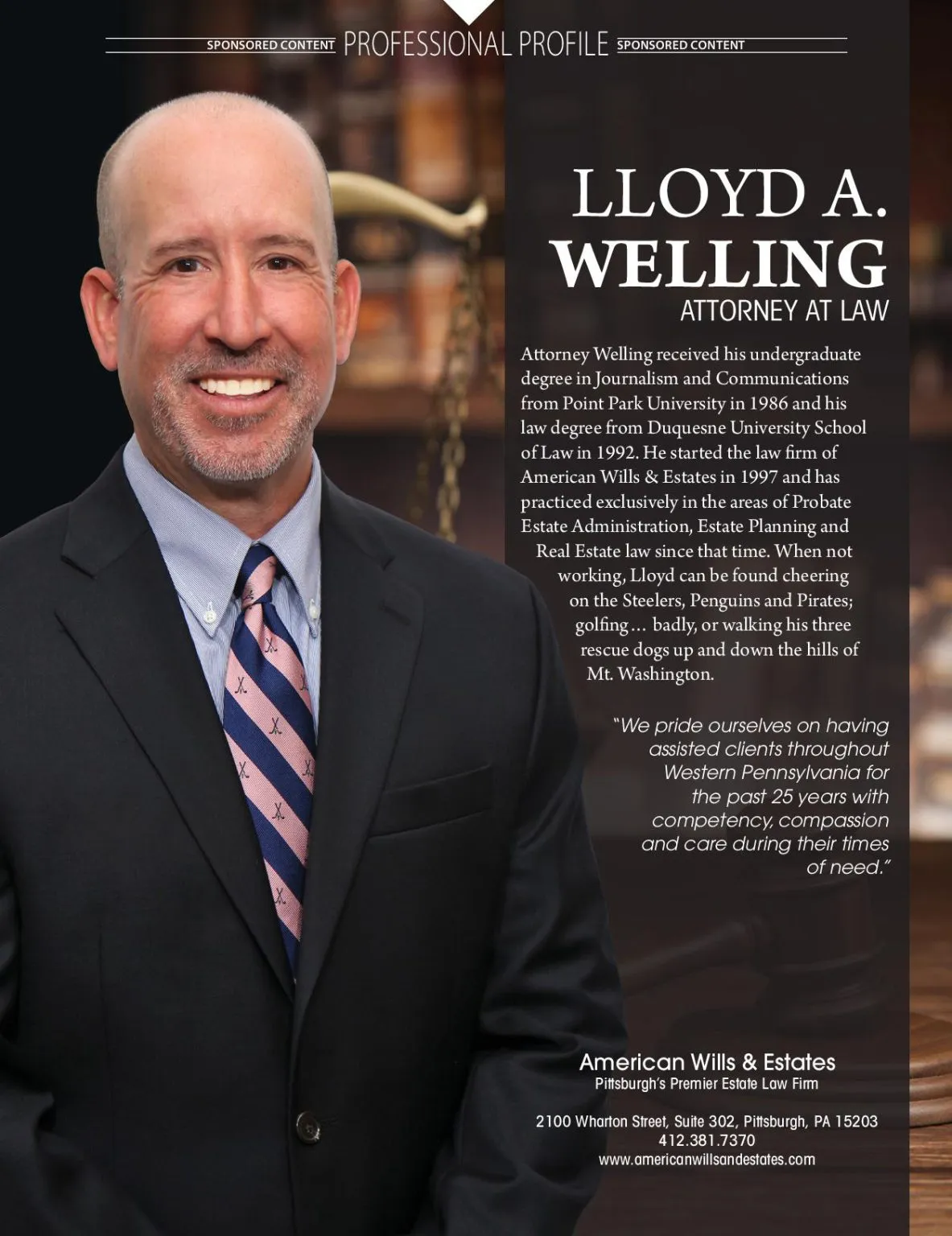

The Team at American Wills & Estates are Estate Planning Experts

We understand that carrying out the timely and appropriate administration of a loved one’s estate can be a daunting and emotional experience. We also recognize that our clients are exposed to, often for the first time, unfamiliar legal terms and concepts. We strive to make the process of estate planning and estate administration as simple and straightforward as possible.

Speak with an Estate Planning Attorney in Pittsburgh, PA

At American Wills and Estates we speak to our clients in plain English, and we are sensitive to the fact that many of our clients are still grieving the loss of a loved one. Our number one goal is to put our clients at ease and to reassure them with competency and compassion in their time of need.

Create an Effective Estate Plan

Creating an effective estate plan can save your loved ones not only money but also unnecessary stress and anxiety at an already difficult time.

Our Pittsburgh based estate attorneys our are experienced with all phases of estate planning and estate administration. If you have been thinking about making a Will or if you already have one and are thinking of making a change, we would like to speak with you.

Learn About Estate Planning & Probate Estate Administration

The attorneys at American Wills & Estates provide expert assistance with planning your estate, estate administration, Wills and Probate. Learn more by reading our frequently asked questions.

Estate planning is the process of accumulating and disposing of an estate to maximize the goals of the estate owner. The various goals of estate planning include, but are not limited to: making sure that the greatest amount possible of a person’s estate passes to that person’s intended loved ones and beneficiaries; paying the least amount possible of inheritance and death taxes on the estate assets; and minimizing or altogether avoiding the extent of the probate process to which that person’s estate might otherwise be exposed. In formulating an effective estate plan, it is important to consider, among other things:

- The size of the client’s prospective estate and what kind of assets (real, personal, monetary) are held in it;

- Who the client’s loved ones and intended beneficiaries are, how old they are, and whether or not any of them have any special needs or disabilities;

- The type and extent of the potential estate or death taxes to which the client’s estate may besubject; and

- What the client’s future goals and financial needs may be.

Proper estate planning should address not only what happens to a client’s assets after his or her death, but also how to best provide for that person’s future needs and physical well being during his or her lifetime. Many people believe that estate planning consists of nothing more than making a simple Will. Obviously, a properly implemented estate plan can entail much more than that. Estate planning may involve not only financial and tax planning, but also medical and business planning. While a Will is certainly an important component of an estate plan, other documents should also be considered and discussed. These may include a Durable Financial Power of Attorney, a Durable Health Care Power of Attorney, a Revocable Living Trust, a Living Will, or even a Special Needs Trust.

At American Wills & Estates we understand that every client’s financial and family situation is unique. We will take the time to fully understand your personal circumstances and your hopes for your family in order to craft an individual estate plan for you that best meets your needs. We will help you accomplish what you want to accomplish, while making every effort to minimize and avoid the effect of estate and after-death taxes on your assets.

Remember, the circumstances guiding your decisions while formulating your initial estate plan are likely to change as your life and financial situation changes. At American Wills & Estates we continue to work with our clients during their entire lifetimes. We want to ensure that their estate plans are not only current as to both Pennsylvania and Federal estate tax laws, but also with respect to carrying out and fulfilling their wishes and goals.

Why We are Different

We provide all of our Estate Planning services including, but not limited to, the preparation of Last Will and Testaments, Durable Financial and Healthcare Power of Attorneys, Living Wills and Trusts on a on a low flat fee basis. For example, simple Last Will and Testaments start at just $75.00. We also provide all of our clients with a free legal consultation so that we can discuss how an effective estate plan can best be tailored to meet that individual’s specific family needs. DON’T TRUST YOUR HARD EARNED LEGACY TO AN ONLINE WILL PREPARATION SERVICE OR A STORE BOUGHT WILL KIT. For the same price, or in many cases even less, you can meet with an experienced estate planning attorney who will custom craft an estate plan that best addresses your family’s specific individual needs.

The lawyers at American Wills & Estates offer extremely affordable estate planning and probate estate administration services. Most of our estate planning and probate administrative services are provided on a flat fee basis. To schedule your FREE LEGAL CONSULTATION, call us today at: 1-877-PA WILLS (1-877-729-4557), or contact us online.

In starting to formulate your estate plan, you should ask yourself the following questions:

- What assets are in my estate and what is their approximate value?

- Who do I want my assets to pass to, when and at what age?

- Who should manage my assets if I become unable to manage them on my own?

- Who would take care of my minor children if I die?

Designate an Executor

Whatever the size of your estate, you should have at least some kind of basic estate plan in place. It is extremely important that, in the event of either your death or incapacity, you have designated a person or persons who can step in and act on your behalf. If your estate is small, you may be satisfied with simply establishing who gets your assets upon your death and who will be in charge of administering and distributing them. However, if your estate is larger, you should be concerned not only with who will distribute and receive your assets, but also with how those various assets can be best preserved and passed on to your intended beneficiaries. Specifically, you should be most concerned with minimizing or avoiding the extent of estate and death taxes to which your assets will be exposed.

Ensure Your Wishes are Followed

If you do no estate planning and die without a Will, Pennsylvania law does provide for the court appointment of a person or persons to administer your estate. However, these laws do not and cannot take into consideration what your specific wishes are or what the particular individual needs of your family members and beneficiaries may be. As a result, your assets may be distributed to someone whom you did not intend to have a share in your estate. Remember, only by leaving a valid Will after your death can you ensure that your assets will be distributed as you intended.

Understand Your Assets

Your probate estate will consist of all property, real, mixed or personal which you own, in your name alone, at the time of your death. Probate assets may include bank accounts, real estate, stocks, bonds, automobiles and miscellaneous household goods and personal possessions. If these type of assets are in your name alone at your death, they will generally pass through your estate pursuant to the terms and conditions of your Will or Trust. However, you may also hold these assets in a manner in which they will pass, either in whole or part, outside of your probate estate.

Specifically, you may hold and own assets that are titled in more than your name alone. You may own assets as a Tenant by the Entirety, a Joint Tenant or even a Tenant in Common with another person or persons. You may also have assets such as life insurance, IRAs, qualified retirements plans and annuities on which you have designated one or more beneficiaries. As you can see, the manner in which your assets are titled during your lifetime can have an extremely important impact on both how and to whom they will pass at your death.

Calculating the Value of an Estate

The value of your estate is calculated by determining the “date-of-death” value of each asset that you own at your death, minus your debts, funeral bill and other probate costs and expenses. The size of your estate is important in determining whether, and to what extent, your estate will be subject to estate taxes and death taxes. Making sure that your children and/or other loved ones have the resources needed to meet such potential tax obligations is another important part of the estate planning process.

A Will, or, more formally, a Last Will and Testament, is a legal document in which you direct how and to whom your property, both real and personal, shall be distributed after your death. In your Will, you will name a personal representative (often referred to as an Executor) who will be responsible for the administration of your estate in accordance with your specific wishes and directives. One important reason to have a Will is so that you can appoint legal guardians and trustees for any of your children who may be minors at the time of your death. These legal guardians and trustees will be responsible not only for the raising of your children, but also for the management and distribution of the estate assets that you have left to them.

Why Should I Have a Will?

If you die without a Will, you shall be considered to have died intestate. This means that your estate will be distributed in accordance with a formula fixed by Pennsylvania state law. The Pennsylvania laws of intestate descent do not and cannot take into consideration your specific wishes or the particular individual needs of your family members. As a result, your assets may be distributed to someone whom you did not intend to share in your estate. Only be leaving a valid Will after your death can you ensure that your assets will be distributed how and to whom you intended.

A Power of Attorney (POA) is a legally enforceable document by which you can designate and authorize another person or persons to act on your behalf in the event of your disability or incapacity. You are called the “Principal” under the document and the person or persons you appoint are called your “Agents.” The authority conferred by the POA may be specific (limited to certain designated transactions like selling a car or a piece of property) or general (applicable to any and all decisions that you would otherwise have to make or consent to on your own).

Power of Attorney Duration

In addition, you can control the time period during which the POA is considered to be in effect by electing to make the instrument either “durable” or “springing.” A durable POA becomes effective immediately upon your execution of the instrument and remains in effect until changed or terminated by you. A springing POA, as the name implies, can spring into and out of effect depending on whether or not certain requirements or criteria set forth in the instrument have been met. Often, the criterion is that your Agent must first obtain a writing from your treating physician attesting to your incapacity.

Power of Attorney in Pennsylvania

Under Pennsylvania law (20 Pa.C.S.A. § 5404): “A principal may, by inclusion of the language quoted in any of the following paragraphs or by inclusion of other language showing a similar intent on the part of the principal, empower an agent to do any or all of the following, each of which is defined in section 5603 (relating to implementation of power of attorney):

- To make limited gifts.

- To create a trust for my benefit.

- To make additions to an existing trust for my benefit.

- To claim an elective share of the estate of my deceased spouse.

- To disclaim any interest in property.

- To renounce fiduciary positions.

- To withdraw and receive the income or corpus of a trust.

- To authorize my admission to a medical, nursing, or similar facility and to enter into agreements for my care.

- To authorize medical and surgical procedures.

- To engage in real property transactions.

- To engage in tangible personal property transactions.

- To engage in stock, bond and other securities transactions.

- To engage in commodity and option transactions.

- To engage in banking and financial transactions.

- To borrow money.

- To enter safe deposit boxes.

- To engage in insurance transactions.

- To engage in retirement plan transactions.

- To handle interests in estates and trusts.

- To pursue claims and litigation.

- To receive government benefits.

- To pursue tax matters.

- To make an anatomical gift of all or part of my body.

A Principal May Also Provide For:

- The appointment of more than one agent, who shall act Jointly, severally or in any other combination that the principal may designate, but if there is no such designation, such agents shall only act jointly.

- The delegation of one or more powers by the agent to such person or persons as the agent may designate and on terms as the power of attorney may specify.

- The appointment of one or more successor agents who shall serve in the order named in the power of attorney, unless the principal expressly directs to the contrary.

- The delegation to an original or successor agent of the power to appoint his successor or successors.

A Revocable Living Trust, also often called a Family Trust, an Inter Vivos Trust, a Grantor Trust or simply a Living Trust, is a legal instrument that is created to hold title to your real property and other assets. Once created, you must “fund” it by transferring the ownership of your assets and holdings to the trust. If properly funded, a Revocable Living Trust can be an effective means of passing your assets on to your children or heirs without subjecting them to probate. However, the proper funding of the trust means everything and should be overseen by a competent legal professional.

A Revocable Living Trust May Not Be Suitable for You

Revocable Living Trusts have become extremely popular in recent years, and are being mass marketed to the public on the radio, on television and at legal or estate planning seminars. However, like everything else, they are not for everyone. If you own multiple pieces of real property or if you have a family business that you intend to pass on to your heirs, perhaps a revocable trust is right for you. However, if your estate is small and your children are grown up and reliable, you can often accomplish the same goal of avoiding probate associated with revocable living trust without the time, complexity and expense associated with creating one.

Remember, before you decide that a revocable living trust is right for you, it is a good idea to speak to at least one or more attorneys who specialize in estate planning.

Probate is a legal term referring to the official “proving” of a Will. It also refers to the formal process by which an Executor or Administrator is appointed by the Register of Wills Office to oversee the administration of a Decedent’s Estate. The process is usually initiated by obtaining either Letters Testamentary (if there is a Will) or Letters of Administration (if the Decedent died without having made a Will).

The Process of Probate Administration

The process of administering a Decedent’s Estate is conceptually a simple matter. The Decedent’s assets are determined and collected, his or her debts and death taxes paid, and the remaining asset are then distributed to the individual’s intended beneficiaries. However, on a practical level the administration of a Decedent’s Estate can involve a number of complexities.

Not all of the assets owned by a Decedent are necessarily subject to probate. Often, a Decedent’s assets may be collected and distributed without the necessity of raising an estate and obtaining either Letters Testamentary or Letters of Administration. Such a determination is made based upon an examination of the size of the Decedent’s estate, the type of property and other assets held by estate, and the kind of ownership interest that the Decedent had in the property at the time of his or her death. The probate process also allows for the determination of any creditors who may have valid claims against your estate at your death.

Probate Advantages and Disadvantages

The probate process can have both certain advantages and disadvantages. If your intended beneficiaries do not get along and are likely to bicker or if they are very young, the probate court can be useful in resolving any disputes or disagreements that may arise about the distribution of your assets. Likewise, you will be assured that the actions of your executor will be subject to both the scrutiny and approval of the probate court. However, one of the major disadvantages of probate is its public nature. After your death, your entire estate plan and the value of your estate will be available for public review. In addition, your heirs will incur greater costs and fees then they would have had your assets passed to them outside of probate or pursuant to a revocable living trust. Finally, time may also be a consideration. Though not always, the probate process can be slow and could result in the delayed disbursement of your assets.

Remember, before you decide that avoiding probate court is right for you, it is a good idea to speak to at least one or more attorneys who specialize in estate planning.

Deciding who to leave your estate assets to is a purely personal matter. You may choose to leave everything to your children in equal shares; you may elect to favor, to some degree, one child or family member over another; you may elect to exclude a child or family member altogether from taking or inheriting any portion of your estate; or you may decide to give all or part of you estate to charity or charities. However, once you have determined who and to what degree your heirs and beneficiaries will be, the attorneys at American Wills & Estates can help clarify your wishes in a well thought out and properly drafted estate plan.

A minor pursuant to Pennsylvania law is any child under 18 years of age. If both parents of a minor are deceased, a minor child is not legally qualified under Pennsylvania law to care for his or her self. As such, it is important in your Last Will and Testament to nominate one or more, individual or joint, guardians of the person and property of your minor child or children.

The title and manner of ownership interest that you have and hold in your assets is critical to the formulation of your estate plan. Before you change the title to your home or to any of your assets, you should understand what the tax ramifications and other consequences of such a change will be. At American Wills & Estates, our attorneys can advise and educate you about such matters.

What is a Living Will or Durable Healthcare Power of Attorney?

A Living Will or Durable Healthcare Power of Attorney is a legal document in which you state, in advance of medical treatment, the type and extent, if any, of medical care that you wish to receive in the event that you become terminally ill or irreversibly brain damaged. Unlike a Will, the terms and provisions of your Living Will are intended to be interpreted and followed during your lifetime, but, generally, only at the very end of same.

Under Pennsylvania law (20 Pa.C.S.A. §5404), “an individual of sound mind who is 18 years of age or older or who has graduated from high school or has married may execute at any time a declaration governing the initiation, continuation, withholding or withdrawal of life-sustaining treatment. The declaration must be signed by the declarant, or by another on behalf of and at the direction of the declarant, and must be witnessed by two individuals each of whom is 18 years of age or older. A witness shall not be the person who signed the declaration on behalf of and at the direction of the declarant.”